State Pensioners Can Learn Lots From Rhode Island And Ohio Teachers

As participants in state and local pensions band together to investigate Wall Street looting, restore transparency and protect their retirement security, highly effective strategies are emerging.

In 2013, I conducted the first-ever forensic investigation of an American state pension. The target of the investigation was the $10 billion Employee Retirement System of Rhode Island and the investigation was commissioned by Rhode Island Council 94 AFSCME—a government workers’ union which had grown increasingly skeptical of management of the fund. In my report, Rhode Island Public Pension Reform: Wall Street’s License to Steal, I revealed how newly-elected General Treasurer Gina Raimondo had under the guise of “pension reform” slashed state workers’ Cost of Living Adjustment retirement benefits, exponentially increased investment fees paid to Wall Street money managers who supported her national political ambitions, and eviscerated state public records laws ending pension transparency (to thwart public scrutiny of the looting). A summary of my findings, as well as a link to the 106-page expert forensic report was published in an article I wrote in Forbes. Due to the serious securities law issues identified, a copy of the entire investigation was provided to the U.S. Securities and Exchange Commission and the Federal Bureau of Investigation.

As noted in the forensic report findings:

“… it is recommended that this report, in general, be provided to securities regulators and law enforcement for appropriate action. However, other specific matters identified herein, i.e., apparent blatant illegalities involving billions in retirement assets nationally, such as hedge funds secretly profiting at the expense of public pensions across the country, demand an immediate, focused response by securities regulators and law enforcement ...”

Local media, unaccustomed to reporting on complex pension management issues, seemed taken aback by the report and only slowly reacted to the emerging story—even as Raimondo’s minions fumed to Forbes. Raimondo “fired back” in a single disastrous local interview, embarassing herself by defending the escalating fees she caused the pension to pay to Wall Street—while admitting to the reporter she did not know the full amount of the fees. On the other hand, the national press response was immediate and critical of Raimondo’s gambling with workers’ retirement savings. In How To Pay Millions and Lag Behind the Market, The New York Times was supportive of the damning investigative findings. Said the Times, “Asked about the problems highlighted in the report, Ms. Raimondo, through a spokeswoman, declined to be interviewed. But in a news release, Ms. Raimondo’s office said the report was motivated by her political enemies.”

Rolling Stone’s Matt Taibbi in Looting the Pension Funds was far harsher calling Raimondo-style pension looting, “the third act in an improbable triple-fucking of ordinary people that Wall Street is seeking to pull off as a shocker epilogue to the crisis era.”

The forensic findings could have been far, far more damning. However, as noted in the report, the overwhelming majority of the information requested from the General Treasurer pursuant to the Rhode Island Access to Public Records Act (APRA) was withheld from pensioners in apparent violation of state law. Raimondo claimed the state was contractually obliged to defer to the Wall Street money managers it had hired on the release of supposedly proprietary information. (Despite boasts of greater transparency and accountability, both of Raimondo’s successors—former Treasurer, now Representative Seth Magaziner and current Treasurer James Diossa—have continued her ruinous pension secrecy scheme to this day.)

In reponse to the investigation, four open-government groups – Common Cause Rhode Island, the state’s chapter of the American Civil Liberties Union, the Rhode Island Press Association and the League of Women Voters of Rhode Island released a letter to Treasurer Raimondo voicing their concerns regarding her strategy of withholding hedge fund records. These groups believed that since the financial reports were paid for with public funds and detailed how the state was investing the public’s money, they should be made public in their entirety; further they found “troubling” the Treasurer’s decision to allow the hedge funds to decide what information to release. As noted in the 2013 forensic report, “The groups should be alarmed— secrecy is critical to the Treasurer’s pension “reform” wealth transfer scheme and she is, in effect, rewriting the rules applicable to public access to state investment information in Rhode Island to accomplish this objective.” Despite their serious concerns, none of the four open government groups challenged Raimondo’s secrecy scheme in court.

Worse still, regardless of the national attention, no member of the State Investment Commission overseeing the pension indicated agreement with any of the investigative findings, or any sympathy for participant concerns.

Subsequently, I completed the first-ever and second “crowdfunded” forensic investigations of a state pension, paid for by participants—this time, with the assistance and support of the fledgling (400-member) Rhode Island Retired Teachers Assocation, which has since disbanded.

In 2015, I released Double Trouble: Wall Street Secrecy Conceals Preventable Pension Losses in Rhode Island which delved deeper into Raimondo’s hedge fund gamble and accurately predicted the pension would lose over $500 million in the next few years. In 2016, I released Beyond Bad: A Generation of Mismanagement of Employee Retirement System of Rhode Island Real Estate which focused on the pension’s longstanding dismal real estate investment performance. Due to the potential violations of law involved, both of these reports were provided to the SEC and the FBI.

Despite the growing public outcry from Rhode Islanders and the three above unprecedented damning expert forensic reports—documenting the biggest financial fraud in the history of the tiny state— workers’ pleas for further action by either of the two Rhode Island Attorneys General in office (first, Peter Kilmartin and then Peter Neronha) were wholly unsuccessful. As I wrote in Forbes, in July 2014, Kilmartin even rejected an appeal by The Providence Journal for access to limited records related to the state pension system’s investment in three hedge funds.

Over the past decade, no one in the state has been willing to fund a lawsuit challenging the repeated withholding of state pension investment records from public scrutiny. (Recently, a group of participants had to go outside the state to find a lawyer with public records expertise willing to pursue their records request because no Rhode Island lawyer would touch it. Current Treasurer Diossa has rejected their request for public records related to the pension’s alternative investments and the group, I am told, is weighing their options at this time.)

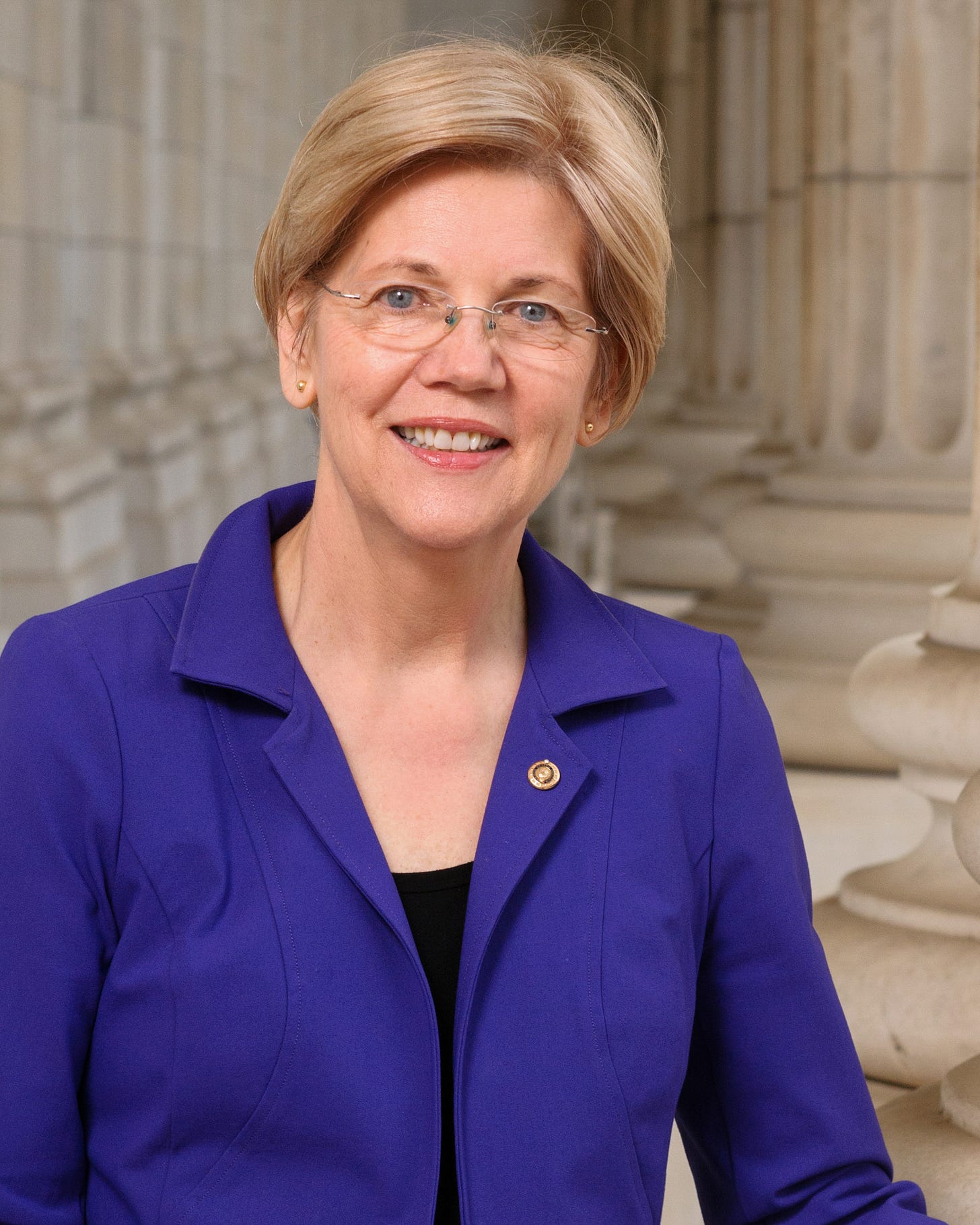

No State Auditor took action. No member of the state legislator rallied to support pensioners. As I wrote in Forbes, despite an initial positive response to state workers from the office of Elizabeth Warren, U.S. Senator from Massachusetts and a self-proclaimed consumer advocate, she failed to offer any support publicly, or take any other action.

In summary, no one—anywhere, on the federal or state level—joined in the effort to stop the looting. Despite the 2013, 2015 and 2016 forensic investigation calls for action, the “immediate, focused response by securities regulators and law enforcement” did not emerge. Ten years later, COLA retirement benefits promised have yet to be restored in Rhode Island. Over the past decade—since I began my investigations into ERSRI—investment expenses have soared from $11 million to $188 million and management of the pension is now worse than ever.

However, there are some recent encouraging developments.

At this time, there are a number of proposals and bills in Rhode Island to restore some portion of the COLA pension benefits previously promised without, or, more likely in lieu of, any further investigation of wrongdoing. (In my opinion, now is not the time to craft a remedy for the years of looting. As I wrote in my book, Who Stole My Pension?, always “investigate before you legislate, negotiate or litigate.”) It seems, after a decade of devouring pension assets, Wall Street and local politicians are willing to throw a few crumbs to workers to stop the grumbling—as long as no one digs deeper into the squandering of workers’ retirement savings.

A new effort to crowdfund a forensic investigation of the pension is also underway: What Happened To Our Pensions Gofundme. A Rhode Island Employees Retirement System PensionWatch Facebook group has been formed to advocate for true reform and already has 340 members. (More about Facebook groups below.) Finally, there is the remote possibility that the recent request by participants for public records—pension investment documents—will be pursued in litigation.

The war for transparency and restoration of promised pension benefits is not over in Rhode Island just yet.

So, what can Rhode Islanders learn from the more recent experience of well-organized teachers in Ohio fighting to improve transparency and management of their state pension?

In 2021, I conducted a forensic investigation of the $100 billion State Teachers Retirement System of Ohio on behalf of the 18,000 member-strong Ohio Retired Teachers Association. That investigation has already produced remarkable and dramatically different results from the Rhode Island experience detailed above which began a decade ago. There is ample reason to believe we are on the verge of even more exciting results flowing from the Ohio teachers’ pension investigative effort.

At the outset, it is important to note that both in Rhode Island and Ohio, COLA retirement benefits promised had been slashed in the past decade and workers/teachers were rightfully pissed to learn Wall Street was secretly prospering at their expense as a result of excessive and largely undisclosed investment fees. To add insult to injury, in Ohio, pension investment staff had for years been awarded lavish bonuses based upon questionable investment performance standards—amounting to tens of millions—as teachers saw their retirement incomes plummet.

The Ohio Retired Teachers Association’s membership (18,000) is exponentially greater than the Rhode Island Retired Assocation’s membership (400) ever was. ORTA, which funded the investigation, is not a teachers’ union but is, in essence, doing the work a union should be doing to protect teacher retirement benefits.

Two Facebook groups, Ohio STRS Members Only Forum (33,000 members) and the STRS Ohio Watchdogs (14,000 members) have long been vigilantly exposing gross mismanagement at STRS Ohio, alongside ORTA and assisted in the forensic investigation fundraising.

The Ohio experience convinced me that Facebook groups can be a powerful force to combat looting of America’s pensions by Wall Street. While for over two decades I have implored unions to get actively involved in scrutinizing the management of pension investments—serving a watchdog function which pension boards are ill-equipped to perform—rarely have I been successful in persuading these unions that the best way to preserve pensions is to expose and address problems, not hide them. (The exception being, as noted above, Council 94 AFSCME Rhode Island which funded the inital forensic investigation.) Some unions may believe any criticism of pensions will only lead plan sponsors to no longer offer defined benefit plans to workers. Other unions actually receive compensation from Wall Street investment firms, in exchange for the opportunity to manage, i.e., loot the pensions of their dues-paying union members.

According to Dean Dennis (President-elect of ORTA), who began working with others on the two Facebook groups in 2019, the effort began with petitions posted on Facebook. Outreach to media and informing members of a class action lawsuit against STRS Ohio alleging violations related to elimination of the promised Cost of Living Adjustment were also critical.

“Traditional unions are supported by active teachers and focus on their issues. I would encourage teachers nationally who are concerned about their retirement security to take action on their own—like we did—and not rely upon unions to watch over their pensions,” says Dennis.

Released in June 2021, the 128-page report titled The High Cost of Secrecy included among its key findings: The pension had long abandoned transparency; legislative oversight of the pension had utterly failed; Wall Street had been permitted to pocket lavish fees without scrutiny; investment costs and performance had been misrepresented; and failure to monitor conflicts had undermined the integrity of the investment process, as billions that could have been used to pay retirement benefits promised to teachers had been squandered. A summary of the findings, as well as a link to the entire forensic report was published for the world to see in an article in Forbes. Due to the serious securities law issues identified, a copy of the damning preliminary findings were provided to Ohio legislators, state and federal securities regulators, law enforcement and later the State Auditor of Ohio.

Unlike in Rhode Island, a single member of Ohio STRS’s sitting board immediately and very publicly agreed with the findings of the report and called for reforms. A second member-elect also strongly publicly supported the findings.

Within days of the forensic report’s release (unlike in Rhode Island where Treasurer Raimondo largely remained silent after an inital “misfire”), STRS staff hastily penned a 5-page response which cited the many experts the pension paid handsomely for guidance, even as it failed to address any of the serious deficiencies noted.

While STRS staff was quick to broadly reassure pension stakeholders all was kosher at the pension, the majority of the pension board stated at the next regular meeting weeks later they were not prepared to discuss the forensic report because they had not had enough time to even read it.

Fully two and a half months after release of the forensic report—when it was clear that the controversy was not going away—pension staff finally prepared an analysis, i.e., rebuttal. The rebuttal was chocked full of embarrassing statements which raised the ire of teachers in Ohio including:

“Paying Wall Street money managers $59 million in fees on uninvested capital is comparable to paying teachers over the summer when they’re not in the classroom.”

“It is unrealistic to demand transparency… investment firms would not risk doing business with government entities...”

“Carried interest is not an investment cost… Carried interest is not a fee.” (Note: the SEC’s website clearly states: “Carried interest is a type of performance fee.”)

"STRS complies with the fiduciary standards… which mirror the ERISA fiduciary standards, and the system maintains adequate fiduciary liability insurance."

In Ohio, unlike Rhode Island ten years earlier, my reputation for pension investigations preceded me with local media. Attention was brought to my forensic investigation even before it began—in connection with the fundraising effort. Said the Fremont News Messenger in October, 2020:

“The Ohio Retired Teachers Association (ORTA) is turning to an equalizer in their effort to restore a cost of living adjustment (COLA) to pensions from the Ohio State Teachers Retirement System.

As TV and film buffs will recall "The Equalizer" was a one-man army defending victimized underdogs against more powerful foes.

ORTA’s equalizer is a lawyer, accountant, whistleblower, columnist and author, Edward Siedle. ORTA leadership has created a bank account to take contributions from members and other interested parties to fund a forensic audit, or search for waste, fraud and abuse, conducted by Ted Siedle and a team of expert peers he intends to recruit to the cause of cleaning up Ohio pensions…

Ohio public pension beneficiaries can’t count on the auditor, attorney general, treasurer or governor to protect against this sort of plunder. Nor can they trust the Ohio Retirement Study Council to perform its most basic statutory duties. Bringing in an equalizer like Ted Siedle, who can find and foil pension pirates, may be the smartest investment Ohio public employees ever have the chance to make.”

Following release of the report, there was limited immediate local news coverage but—much to the chagrin of STRS—nearly two years later, the story has still not gone away and has only gained momentum. Week after week—to this day—controversy surrounding mismanagement at the pension continues to be reported upon. The Toledo Blade, which has reported extensively on past Ohio pension wrongdoing (Ohio of Workers Compensation/Coingate), has been particularly critical of STRS management.

Local NBC4 News co-anchor Colleen Marshall in Columbus, has been dogged in her reporting on the developing controversies surrounding the pension.

On the national level, NBC News wrote:

“The STRS report … blasts the pension plan's managers for refusing to hand over investment records that beneficiaries need to assess the full costs of the fund's investments and their true performance.

The report raises questions about the pension plan's elimination of the cost-of-living increase, for example. It said the fund might be able to reinstate those payments if it didn't abide by a common practice in the industry — paying private equity managers for money it has committed to invest but hasn't yet deployed. Paying fees on capital committed to a private equity firm but not yet invested is typical among investors in such holdings. The report calls the practice “money for nothing.””

Months after the investigation’s findings were released, three more candidates supported by ORTA were elected to the STRS board, for a total of 5 in support of reform. Remarkably, in February of this year, the 11-member board of the pension in a split vote rejected a motion to declare confidence in STRS’s Executive Director, who has presided over the fund since June 2020. The final vote — five in favor, five against and one abstaining — fell short of the six votes needed to assert confidence in the Executive Director.

“We have to have a change at the top,” said STRS board member Julie Sellers, who introduced the motion. “The problems that have been here have been here for years, and I just feel like we need to have a direction forward.”

As in Rhode Island, the pension refused to provide the key investment documents in response to our public records request. However, unlike in Rhode Island, former Ohio Attorney General Marc Dann immediately agreed to represent us in litigation against the pension and our case is headed to the Ohio Supreme Court later this year.

The forensic report pointed out that Ohio law requires the STRS fund to undergo performance audits every ten years conducted by the Ohio Retirement Study Council, a group appointed by leaders of the Ohio House and Senate and the governor. But the last audit was in 2006, 15 years ago. Solely as a result of participant action, statutorily-mandated fiduciary and actuarial audits of the $100 billion pension, long overdue, were finally undertaken.

Spurred by participants sending the report which, in his opinion, provided a “reasonable basis” for a special investigation, the State Auditor of Ohio, Keith Faber, undertook a year-long review, ultimately recommending that all investment documents related to the pension should be made public. As of this date, Faber is the only state auditor to investigate any state pension and the only to recommend restoration of full transparency. (Ironically, a year earlier—a month after the damning forensic findings were released in 2021—the State Auditor had given the pension his highest transparency rating.)

Like in Rhode Island, the Attorney General of Ohio has failed to take notice of the highly-publicized teacher pension controversy and has taken no action. Nothing.

Facing mounting pressure, in March, 2022, the pension board unanimously approved a one-time 3% cost-of-living adjustment for eligible retirees—a COLA which it had eliminated in 2017 supposedly due to concerns about the pension fund’s long-term viability. The move did not reinstate the COLA permanently like many retirees advocated for, but board members signaled more adjustments were possible in the future. (So, in Rhode Island ten years after the three forensic investigations of the state pension, only now are proposals to restore some portion of the COLA being proposed; in Ohio, within a year of the forensics, some COLA benefits were restored.)

Finally, and most important, this month there is an election for one active, or contributing member seat on the STRS board—the outcome of which will be determined in early May. If the reform coalition candidate wins this seat, it’s likely control of the board will shift. Then the concerns of the state auditor and reform-minded members will be addressed regarding the need to restore transparency, lower investment fees paid to Wall Street, improve investment performance and move toward restoring benefits previously promised. If so, STRS Ohio’s participant-driven reforms may serve as a template for all of the nation’s public pensions. (On the other hand, if our request for public records is granted by the Ohio Supreme Court later this year—and court-ordered transparency ensues—there may be little need for board action because any mismanagement or wrongdoing will have been exposed to the public.)

But here’s the big picture: Since all public pensions in America have moved like a herd, pouring over $1 trillion into many of the same high-cost, high-risk secretive alternative investments, if any single state pension—such as Rhode Island, or Ohio STRS—restores full transparency and releases alternative investment information to the public revealing widespread industry abuses and violations of law, all participants in public pensions which have also invested in these funds, as well as taxpayers, will benefit. One obscure pension fund board vote in Ohio could ultimately force the transparency and accountability Wall Street has successfully resisted for decades.