Ohio Teachers Pension Fees Are More Than Double What The Pension Reported

In 2021, when STRS Ohio was touting investment fees of only $279 million, we estimated fees of nearly $1 billion. A new analysis based upon pension reports shows total fees of over $800 million.

In June, 2021, my firm issued a blistering report entitled The High Cost of Secrecy: Preliminary Findings of Forensic Investigation of State Teachers Retirement System of Ohio, Commissioned by Ohio Retired Teachers Association. As we noted at the outset of the report, the overwhelming majority of the most critical disclosure information we requested pursuant to state public record laws regarding the pension was summarily denied. Most disturbing, not a single prospectus or offering document required to be provided to all investors under our nation’s securities laws was provided in response to our public records request.

In our findings, we included our estimate of the total investment fees and expenses the pension paid to Wall Street. Our estimate was based upon expert knowledge of industry practices. However, we were not provided with any of the documents which would have enabled us to prove the exact amounts actually paid. Worse still, we were not even able to establish whether the pension itself possessed the key documents—documents required for the pension to substantiate its fee disclosures.

Here's what we said in 2021:

“It is stated that the pension’s investment cost of 40.1 basis points was below its benchmark cost of 54.5 basis points which suggests that the fund was low cost compared to its peers., i.e., was low cost because it paid less than its peers for similar services and had a lower cost for implementing its style. The report later states that the investment costs were $279.1 million or 36.9 basis points and $302.8 million or 40.1 basis points when hedge fund performance fees and private equity base management fee offsets were added. However, it is disclosed that transaction costs and private asset performance fees were not included in the latter total.

Further in the report, performance fees of $160.8 million are estimated in 2018. When performance fees of $160.8 million are added in, the revised fee total rises from $279.1 million, then $302.8 million to $463.6 million or 61.3 basis points, versus the 40.1 basis points noted earlier. This cost is significantly greater than the fund’s benchmark cost of 54.5 basis points, suggesting that STRS was high cost compared to its peers. Again, these findings appear to be strikingly different from those publicly touted by STRS. However, it appears that even the $463.6 million estimated total cost is incomplete.

In our opinion and based upon forensic investigations we have undertaken, there is ample reason to believe the total fees are nearly double what the pension is reporting, amounting to almost $1 billion annually. To put the hidden, unreported fees—alone—into context, they amount to $2.75 million per school day, and more than twice the $210 million required to pay STRS COLAs annually.”

In summary, in 2021, lacking any of the key investment reports, we estimated total fees of nearly $1 billion, while the pension—with complete access to all documents—reported fees of only $279 million.

A month later, in August 2021, STRS Ohio fiercely disputed our estimate, preposterously asserting—contrary to the federal securities laws (and the SEC’s website)—that performance fees are not investment costs!

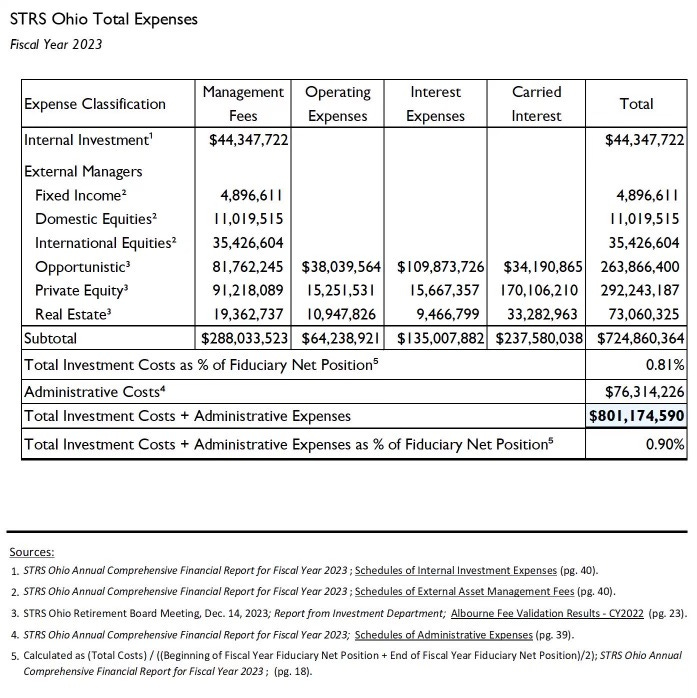

We recently were made aware of the following Total Expense disclosure prepared for certain members of the STRS Ohio board detailing fees amounting to—wait for it—in excess of $800 million.

That’s far closer to the near $1 billion we estimated—again, without access to any of the investment documentation we requested from the pension. We have every reason to believe this higher fee analysis, while closer to the truth, fails to include all multiple layers of fees and expenses.

So, how could a state pension with 500 employees and full access to all documents related to its investments, have under-reported the fees by $500 million? That’s the question pension stakeholders, including participants and taxpayers should be asking.