Learn To Steal To Protect Yourself From Investment Scammers

For the student of investing, the choice is simple—either study bad behavior and be forewarned, or risk losing everything you own.

When men, women, and families are victimized by financial criminals, it’s devastating. People lose their sense of safety, control, self-worth, and even purpose. It happens far, far more often than you might believe.

While forensic and fraud accounting experts estimate that the cost of fraud globally amounts to trillions annually, the true figure is exponentially greater. The overwhelming majority of investment scamming is not included in global estimates because fraud experts with accounting backgrounds are not trained to identify the myriad forms of scamming and aren’t looking for it.

For example, the forms of harm to investors I focus upon in my forensic investigations are not generally factored in the overall damage calculations by accountants focused upon numbers alone.

My estimate—based upon decades of experience—is that well over half of all investing involves scamming of one sort or another.

I believe that through learning the art of investment scamming at the highest levels—implicating many of the world’s most respected and trusted (and therefore most dangerous) financial institutions—you can be better equipped to defend yourself and your family in the life and death struggle that plays out every day between investors and Wall Street.

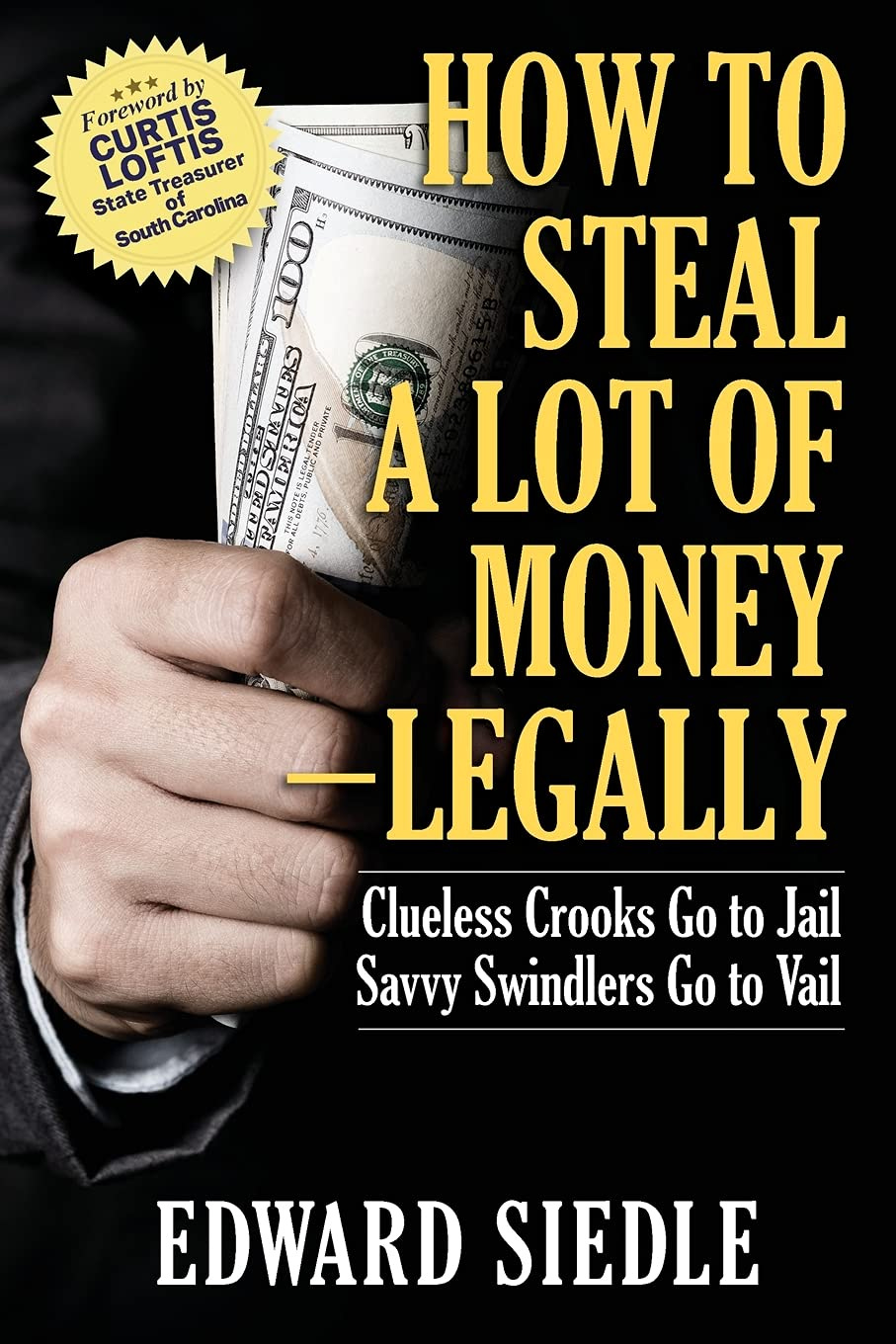

Stopping fraud globally is an impossible task. On the other hand, defining and exposing scams that pose the most serious risk to your overall wealth-health is doable, and in my book, How To Steal A Lot of Money—Legally we do just that. I call it a “gonzo course in financial literacy” or “financial literacy on steroids.”

A complete education should include learning the bad and the ugly—not merely the glorious and meritorious. The student should be taught what is, not merely what should be—the way things really work in the real world, not how they are supposed to work in a perfect world.

Lying, cheating, and stealing are so commonplace in life generally, and in the world of investing especially, that they are not the exceptions. Scamming mercilessly overwhelms any so-called rules and devours those who play by them. So, learning “rules” without learning the even greater larcenous “exceptions” makes no sense—it’s reckless. Schools and professors who teach the “rules” alone are negligent, in my opinion and put students, at a minimum, at a competitive disadvantage, or, worse still, in harm’s way.

An education which ignores, or excludes, the study of pervasive repugnancies only ensures certain unscrupulous insiders will continue to be able to blithely manipulate and mislead the clueless masses, depriving investors of their hard-earned savings and undermining confidence.

For the student of investing, the choice is simple—either study bad behavior and be forewarned, or risk losing everything you own.

To order the book click here.

Couldn’t agree with you more; and it can be done with children as early as in the primary grades as part of the curriculum. The earlier one exposes a child to possible scams that they can understand, the better equipped they will be in awareness of a ripoff.

Yes, the reality of how the slick and clever prey upon the financially naive and unsophisticated is an old tale that should be part of the core high-school curriculum - so that those who “shove $300 megawatts up Grandma’s ass” (Enron) have an education in morality and just maybe, maybe hesitate to engage in such greedy and despicable treachery toward their fellows.